My Financial Truths Chapter One

Mike Norton Talks About Bond Financial Issues

FOR THE BEST SCOTTSDALE, A POLITICAL ACTION COMMITTEE, CO-CHAIR

Hi, I’m Mike Norton, CoChair of our PAC. I’m proud to be involved in this project. I wanted to bring one of my professional strengths to this effort. I studied Law, Economics and Accounting in undergraduate school and the University of Utah Law School. My career includes a lot of work with governmental institutions and formal committees at the national and international level. My LinkedIn page describes some of them. I won’t repeat them here.

I’ve studied the City’s Audits, Budgets and Bond history. I’ve had the help of more than one great professional in this task. I want to share what I’ve learned and give you links to the hard data so you, too, can prove to yourself how our City stacks up financially. I’m comfortable that you’ll share my beliefs when you’re done. If I haven’t answered all your questions, test me to find more answers. I’ll do what I can.

Now let’s talk Bonds.

CHAPTER ONE: WHAT DO WE OWE AND HOW MUCH DOES THE BOND MARKET TRUST SCOTTSDALE?

Like anyplace else, a lot of rumors and urban legends are alive in Scottsdale. Among them are the notions that Scottsdale is swimming in debt (claims of up to $2 billion of debt abound). And that Scottsdale’s debt load is overwhelming to the City and taxpayers. Both of those myths need to be addressed.

First, Scottsdale City Bonds are Triple A Rated by the top 3 Bond Rating firms in the United States. Scottsdale is one of only 30 cities nationwide that can make that claim. The Big 3, Standard & Poor’s, Moody’s and Fitch Group rate approximately 95% of the municipal bonds sold globally. The three rating agencies audit Scottsdale annually. The rating agencies’ reputations are on the line. Triple A Ratings are not issued lightly.

The City’s own Audited Annual Financial Report is audited by the Rating Agencies and its budgets are compared from year to year to assure that the City is conservative in its spending, accurate in its reporting, and provides reserves for bad times to assure that it won’t default. (The City has never defaulted.)

Second, Scottsdale is rapidly retiring its nominal debt load. We repay an average of $80 million of bonds annually. That happens on purpose. The City carefully managed our debt obligations so the Bond obligations are relatively equal year over year. As this Bond is passed, we will issue about $50 million of new bonds annually. Our debt will reduce even though we sell new Bonds. We are simply paying off old bonds faster than we issue new Bonds.

Third – how much do we owe? I’ve researched our existing Bond obligations. I tested my data by sending it to City Treasurer, Jeff Nichols. In his personal time he found my mistakes, helped me understand them, and helped me draft this summary. This debt summary ties out to the City’s books. You can find the City Audit Report and Budget Reports at this link. Please use it and prove to yourself what I’ve learned.

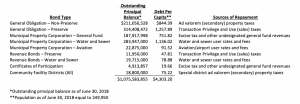

The following are brief descriptions of bonds outstanding at June 30, 2018. The totals shown are the principal amount outstanding, net of the amount due July 1, 2018. By June 2019, the total Bond debt will drop to or below $1 billion. So, No, we are not $2 billion in debt. Also please note that about 30% of our Bond Debt is for the Preserve. We voted to issue those Bonds in two different elections. We created a superb asset in the process. Those Bonds are not paid with Property Taxes. They are paid with a special Sales Tax that phases out in two tranches through 2034.

Our Municipal Bonds also have zero impact on Property Tax. They are paid entirely by users of the systems. Aviation Bonds are paid by Airport user fees. Water and Sewer bonds are paid by users of our Water, Sewer and Garbage systems. We have the lowest Water and Sewer rates of our peers.

The ONLY BONDS THAT IMPACT PROPERTY TAXES ARE THE NON-PRESERVE GENERAL OBLIGATION BONDS.

There will remain less than $200 million of those Bonds still outstanding at June 2019.

General obligation bonds are repaid with ad valorem (secondary) property taxes. The bonds are direct, general obligations of the City and the Mayor and City Council is obligated to levy annually an ad valorem tax for payment of the principal and interest on the bonds upon all the taxable property within the city. Preserve bonds, both general obligation and revenue, are repaid through the 0.2 percent City sales tax approved by voters in May 1995, and an additional 0.15 percent sales tax increase approved by voters in May 2004. Municipal Property Corporation bonds are repaid with unrestricted revenue including but not limited to excise (sales) taxes, franchise, privilege and business taxes, State-shared sales and income taxes, fees for licenses and permits and State revenue sharing, fines and forfeitures and other eligible uses as determined by the City, including Arizona Sports and Tourism Authority (AZSTA) funds, utility and enterprise revenue and tourism development fund allocations.

Water and sewer revenue bonds are issued and authorized by the voters for the construction, acquisition, furnishing, and equipping of water and sewer facilities and related systems. The water and sewer revenue bonds are collateralized by revenue in excess of operating and maintenance expenses of the City’s water and sewer utility system and are repaid via user charges or fees for service. Property taxes cannot be used to pay the debt service on these bonds.