My Financial Truths Chapter Two

Mike Norton Talks About Bond Financial Issues

FOR THE BEST SCOTTSDALE, A POLITICAL ACTION COMMITTEE, CO-CHAIR

I’ve already written a Chapter for this blog. It was called “CHAPTER ONE: WHAT DO WE OWE AND HOW MUCH DOES THE BOND MARKET TRUST SCOTTSDALE?” I hope you read it. I’m Mike Norton, CoChair of our PAC. I’m proud to be involved in this project. I’ve studied the City’s Audits, Budgets and Bond history. I’ve had the help of more than one great professional in this task.

I want to answer some great questions that were raised by those who read Chapter One. Let’s talk Bonds and Taxes. And let’s make sure we’re all on the same page as we move forward. A few of you asked the same two great questions. I’ll answer both of them today.

QUESTION ONE from N.V. and others: Will our Secondary Property Tax Really Go Down?

Yes it will. (see below for a lot more detail)

QUESTION TWO from J.T. and others: Will all of our combined property taxes go up or down when totaled?

That can’t be answered either by the City or by me. Since over 90% of Property Taxes are assessed by the State and County and others, the City Assessed Property Taxes are less than 2% of all your Property Taxes. (also see below for a lot more detail)

Question One from N.V. and Others:

“I recently heard Linda Milhaven say (in public) that “property taxes will go down, even if all three bond questions pass.” This seems to be a popular sentence as I’ve heard it in a few places. (Yes, I wrote those words here, too, as have many other City Council and Staff members.)

Of course, this would be great. But in thinking about it further, I’m wondering whether…

– This may be true of the secondary taxes (where old bonds are expiring).

– But perhaps not true, once the +1.76% primary tax increase is added to that.

What I do feel certain about, is that the vast majority of citizens do not think in terms of primary vs secondary property taxes. They just know what they pay, “bottom line”, for property taxes.

– If the “bottom line” number (bond assessments for Q 1, 2 and 3, PLUS the increase of 1.76%) will be less than a citizen’s current property tax value, then it would be fine to say that property taxes will go down, even if all three bond questions pass.

– If that is not the case (once the 1.76% increase is added) then this would be misleading in terms of consumer takeaway/understanding.”

ANSWER FROM MIKE NORTON with assistance from City Treasurer Jeff Nichols (in his personal time) and City Council Member Solange Whitehead (in her personal time).

Secondary Property Taxes (Ad Volarem Taxes) will go down regardless of the issuance of the new Bonds. Primary Tax Rates are not impacted in any way by General Obligation Bond issuances.

The General Obligation Bond Issuance cannot possibly have any impact on Primary Tax Rates since Primary Taxes are not used for General Obligation Bonds.

General Obligation Bonds are paid from ONLY two sources.

1. In the case of the Bonds issued to buy the Preserve lands, those bonds are paid solely from Sales Taxes. Those taxes expire in two tranches with the last tranche ending in 2034. They do not impact property taxes in any manner.

2. General Obligation Bonds other than Preserve Bonds are repaid solely from the Ad Valorem or “Secondary Property Tax” sources. The Mayor is required by law to assess sufficient Secondary Taxes each year to repay all Bond Principal and Interest that is due that year. And nothing more.

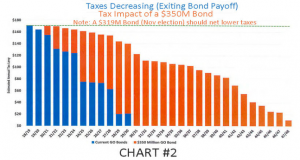

3. General Obligation Bond Totals Are Dropping and Will Continue to Drop (including old bonds still outstanding and new bonds that will be issued).

4. There are two reasons we can’t issue new Bonds faster than old Bonds are retired.

a) Our current Secondary Tax Rate was based on the amount needed to pay or retire the $211M of General Obligation Bonds that were still outstanding in June 2018.

b) When we start issuing new Bonds post election, the Balance owed on old General Obligation Bonds will be less than $170M. Down more than 20% since June 2018.

c) It will take the better part of a year to get new Capital Projects designed, proposed by Staff, approved by Council, RFP’s issued, contracts awarded and Bonds issued.

d) It is nearly inconceivable that we could possibly issue enough new bonds fast enough to catch back up to the 2019 Bond balance levels, let alone the 2018 Bond Balance levels. It is almost theoretically impossible for our Secondary Tax Rates to do anything other than drop. We quite simply cannot spend money fast enough to require enough debt to keep our General Obligation Bonds at or above $211M.

Please see the Guest Editorial from Solange Whitehead in the Arizona Progress and Gazette.

QUESTION TWO FROM J.T. AND OTHERS:

“How can you promise me my Property Taxes will go down? Aren’t there other property taxes assessed against my home by schools and things like that? How do my Scottsdale Property Taxes compare to other Cities? Is it true that Scottsdale has the highest tax rates in the County?

ANSWER FROM MIKE NORTON and JEFF NICHOLS (in his personal time):

This is a reminder that we as advocates for the Bonds have to be very precise and emphatic about our message. Secondary Property Taxes are assessed only by the City where you live. Scottsdale Secondary Property Tax Rates will go down whether our Bonds are approved by Voters or not. Scottsdale Primary Property Tax Rates will not be effected by the Bond request. We will be precise and emphatic as we go forward.

SECONDARY PROPERTY TAX RATES WILL GO DOWN. NO OTHER PROPERTY TAX ASSESSED AGAINST YOUR HOME WILL BE IMPACTED BY THE BONDS.

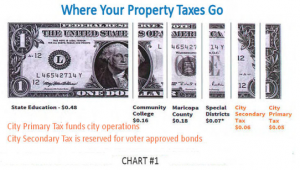

Secondary Property Taxes are only $0.05 of the $1.10 rate per thousand that are assessed against your home. Most of the property tax paid by you goes to State Education funds (Universities and K-12’s), the Community College Network, the County and Special District. Scottsdale City taxes your home very lightly compared to the other $0.99 per thousand others charge.

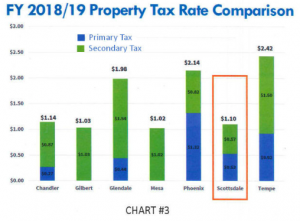

Scottsdale Property Tax Rates are actually quite low compared to other cities in this County. Contrary to urban legend and doomsdayers, Scottsdale City Property Tax Rates are low. Scottsdale has the lowest Secondary Property Tax Rate of any City in the County. Even after the Bonds are passed we will remain the lowest unless some other City retires a large block of its Secondary Tax funded General Obligation Bonds.

Even after adding Primary Property Taxes in, Scottsdale’s Property Tax Rate is lower than all cities except Gilbert and Mesa. No offense meant to Gilbert or Mesa, but we expect more from Scottsdale than Mesa delivers. We live here for a reason. We want the best and we get it despite paying the third lowest Primary and Secondary Tax Rates in the Valley.